Maturation of GaN Market Evident at Recent Power Events Worldwide

GaN PSUs expected to dominate huge market sector from 30W to 20kW

Attendance at global power electronics trade shows this year such as APEC, ChargerLab’s Charging Expo and PCIM are up year-over-year on average by around 10%. Behind the razzmatazz that accompanies any trade show there’s a serious point, as espoused by Balu Balakrishnan, CEO of Power Integrations.

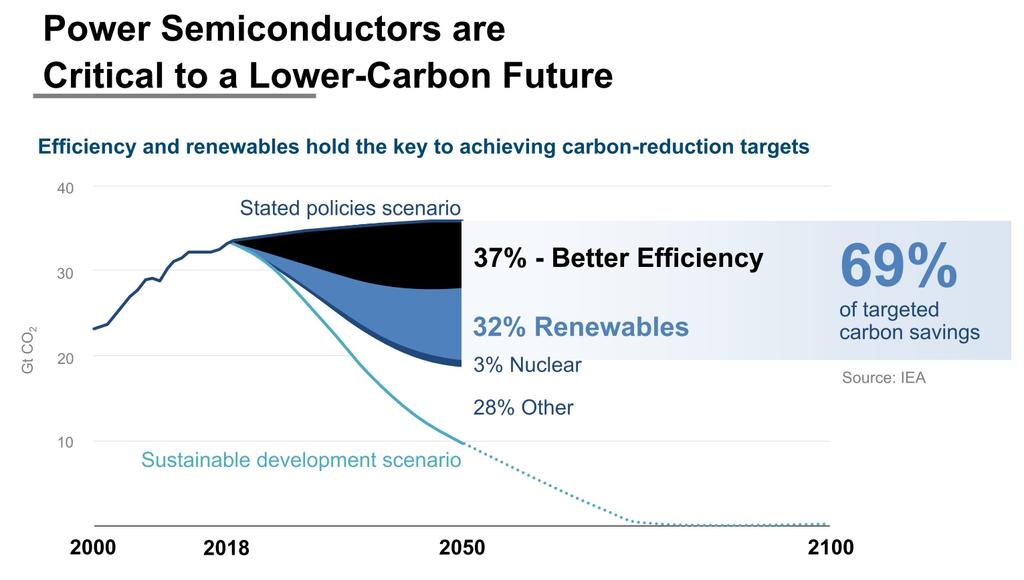

In his plenary address at APEC earlier this year, Balakrishnan stated: “Efficiency and renewables hold the key to achieving carbon-reduction targets”, and that therefore “power semiconductors are critical for a lower-carbon future”, facilitating “69% of target carbon savings.”

It is indisputable that the technology that has had the biggest impact on the power semiconductor industry in the last five years has been Wide Bandgap - gallium nitride (GaN) and silicon carbide (SiC) – devices, with GaN especially emerging as the power semiconductor technology-of-choice for many applications due to the high efficiency and high power density systems they enable.

It may be too early to describe GaN as a ‘mature’ technology, but it is certainly heading that way. Aside from the sheer numbers of new GaN-based devices that are being introduced – Balakrishnan says that for “anything above 30 W, (Power Integrations) uses GaN” - and the volume of discussions at APEC and elsewhere, there are other indicators.

The GaN industry is consolidating; recently we have seen the completion of the acquisition of GaN Systems by Infineon and the announcement of Renesas’ intent to acquire Transphorm. Other deals are likely to follow.

Picking up on Balakrishnan’s view that for applications above 30W GaN is the obvious choice, APEC heralded another trend concerning GaN. Six years ago at PCIM, a leading GaN exponent was heard to offer a wager that GaN would not be used in commercial systems in the near future. A year later, Power Integrations announced that it had shipped over one million GaN-based IC solutions to charger maker Anker. Chargers then and now are the ‘low hanging fruit’ where makers can prove their GaN devices in a market where reliability – although desirable – is not of paramount concern. Now that GaN is better understood, the performance and reliability are proven, and design-in issues such as how to drive GaN are solved (incidentally, this was never an issue with Power Integrations’ GaN ICs, because driver and protection circuitry are included in the power supply IC), GaN is ready to move into the next level of applications where reliability and power levels are much higher. At APEC there was a significant momentum for GaN to be used in industrial power supplies and power systems in data centers.

Power Integrations has released a GaN device rated for 1250 V, significantly higher than any other available GaN offering from any other competitor. InnoSwitch3-EP 1250 V (reference design) facilitates applications up to 5kW, which is needed for AI servers and 5G base-stations. Power Integrations also thinks that 10-20kW GaN power supplies are also going to be practical in the very near future, opening up the automotive on-board charger and DC/DC converter markets. As Balakrishnan says, almost any market from 30W to 20kW can be addressed by GaN using conventional power topologies.